The concept of electronic wallets, also known as e-wallets, has been around since the 1990s but has seen tremendous growth and adoption in recent years, the first e-wallets were developed in the late 1990s for the purpose of online shopping.

Companies such as PayPal, founded in 1998, and Google Checkout, founded in 2006, pioneered this technology. However, due to security concerns and a lack of trust in these early systems, their adoption was slow. E-wallets are digital versions of traditional wallets, allowing users to store, manage, and spend their money online or in physical locations.

The widespread adoption and development of mobile technologies in the early 2000s marked a turning point for e-wallets, with the advent of smartphones and mobile payment options, e-wallets became more accessible and user-friendly. In 2011, Google launched its mobile payment platform, Google Wallet, which allowed users to make payments using their mobile devices.

The growth of e-commerce and the COVID-19 pandemic have further fueled the popularity of e-wallets. Consumers worldwide are increasingly turning to online shopping and contactless payment options. Many e-wallets now offer a range of features, such as loyalty programs, budgeting tools, and money transfer services, making them more appealing and convenient for users.

How e-Wallets Work

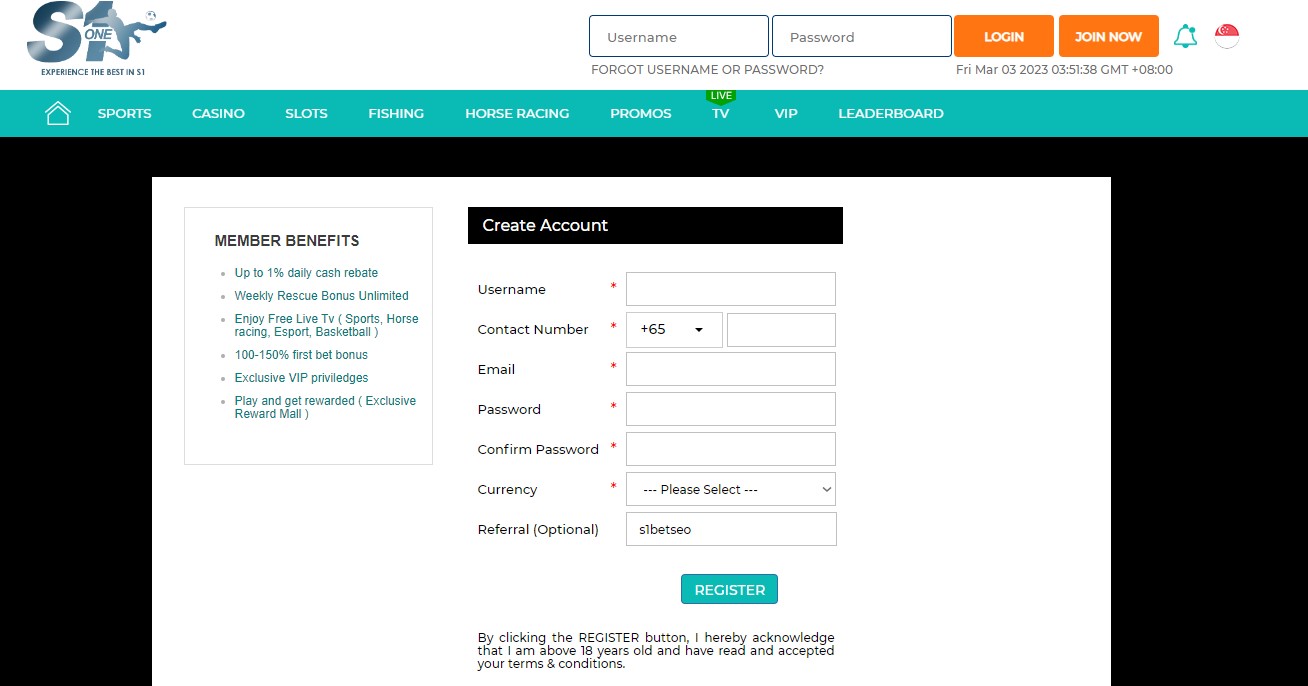

To use an e-wallet, an individual would first need to set up an account with their chosen provider. Once the account is created, they can then add E-wallet deposits at online casinos to the wallet through various methods, such as bank transfers or credit card transactions. The funds can be used to make purchases or transfer money to other e-wallets, as well as withdraw cash through authorized agents.

One of the key features of e-wallets is the encrypted security protocols employed to ensure the safety of users’ sensitive information and funds. Data encryption is used to protect users’ details and funds, and in some cases, users may be required to enter a secure password or pin code to access their e-wallet.

E-wallets can be used for a variety of transactions, such as paying bills, purchasing goods and services online, or sending money to others. When using an e-wallet for transactions, users can do so through various methods such as a QR code, near-field communication (NFC) or simply sending funds through a linked bank account or credit card.

Types of e-Wallets

Mobile wallet

As the name suggests, this type of wallet is accessed through a mobile device such as a smartphone or tablet. Mobile wallets are often integrated with other mobile apps, such as banking apps, and allow users to make payments through their phones. Some popular mobile wallets include Apple Pay and Google Pay.

Web wallet

This type of wallet is accessed through a web browser on a computer or mobile device. Web wallets allow users to store and manage multiple types of digital currencies, such as Bitcoin or Ethereum. Users can also make transactions directly from the wallet.

Prepaid or Stored-value wallet

This type of wallet allows users to load funds onto the wallet in advance and use them to make purchases. Prepaid wallets are often used for online shopping and can be linked to a debit card for added convenience.

How to Choose an e-Wallet

With so many e-wallets available in the market, it can be difficult to know which one to choose, we will look at the factors to consider when selecting the right e-wallet for you.

Security

When dealing with financial matters, security should always be a top priority. When choosing an e-wallet, ensure that the provider has security protocols in place to protect your personal information. Look for providers that use end-to-end encryption, two-factor authentication, and anti-fraud measures. Read reviews or seek recommendations from friends or family members who have used the service.

Compatibility with your device

Not all e-wallets are compatible with all smartphones. It is essential to determine whether the e-wallet available supports your smartphone’s operating system before choosing a service. Common operating systems include iOS and Android. If you are unable to use a particular service, consider other options that are compatible with your device.

Integration with other services

It is essential to consider e-wallets that are integrated with other relevant services such as online shopping, food delivery, movie bookings, and so on. An e-wallet that serves this purpose would make life much more effortless and more comfortable as transactions can be completed effortlessly.

e-Wallet Security

The security of e-wallets has become a major concern for both companies and customers, we will explore some of the security measures that companies and customers can take to ensure the safety of e-wallets.

Encryption

Encryption is a crucial security measure for e-wallets. Encryption involves using codes to convert sensitive information such as passwords and financial details into a secure code that is difficult for hackers to decipher. A strong encryption algorithm can make it extremely difficult for someone to gain unauthorized access to an e-wallet.

Two-Factor Authentication

Two-factor authentication is another security measure that can help prevent unauthorized access to e-wallets. This process involves requiring users to enter their password and a unique code sent to their mobile phone before they can access their account. This second layer of authentication adds an extra barrier preventing hackers from gaining access.

Using Personalized Security Questions

Personalized security questions can also add an additional layer of protection to e-wallets. Customers can select and answer a series of questions unique to them. In the event of suspicious activity, these questions can help verify the identity of the customer and prevent unauthorized access to the account.

Pros and Cons of Using an e-Wallet

Pros:

- Convenience: E-wallets offer unparalleled convenience due to their ability to merge multiple forms of payment. Users don’t need to carry around different cards, cash, or confirmation receipts, making shopping and paying bills much easier.

- Security: E-wallets offer a higher level of security than traditional payment methods. Since users don’t have to swipe their credit cards or share bank account information, the risk of identity theft and fraud is lower.

- Loyalty programs and discounts: E-wallet providers offer rewards and discounts that incentivize users to use their platform. These rewards programs may include cashback, exclusive deals, and loyalty points.

Cons:

- Limited compatibility: Not all merchants accept e-wallets, making it challenging for users to rely entirely on the platform. Users will still need to carry alternative payment methods to shops that only accept cash or traditional payment methods.

- Payment Issues: Technical issues, server failures or network disruptions may occur while using e-wallets. These problems can cause transactions to fail or take longer than expected.

e-Wallet minimum deposit restrictions

One of the challenges that users face when using e-wallets is the minimum deposit restrictions. This refers to the minimum amount of money that users are required to E-wallet deposits at online casinos into their e-wallets before they can make any transactions.

There are several reasons why e-wallet providers impose minimum E-wallet deposits at online casino restrictions. One of the main reasons is to cover the cost of processing transactions. E-wallet providers have to pay fees to payment processors and other intermediaries involved in processing transactions. The minimum deposit helps to ensure that the provider can cover these costs and still make a profit.

e-Wallet Deposit Fees & Deposit Limits

E-wallet deposit fees are charges incurred by users when they transfer funds into their e-wallets. These fees vary depending on the provider and the country in which the user is located. For example, some e-wallet providers do not charge any deposit fees at all, while others may charge a flat rate or a percentage of the total amount being transferred. These fees are typically used to cover operational costs and to maintain the security and functionality of the e-wallet platform.

Deposit limits, on the other hand, are restrictions placed on the amount of money that users are allowed to transfer into their e-wallets. Depending on the provider and the user’s account status, deposit limits may vary. These limits may be set daily, weekly, or monthly and are designed to prevent fraudulent activity and money laundering. In most cases, users are required to verify their identity and provide additional information before they are allowed to increase their deposit limits beyond the initial threshold.

e-Wallet Deposit Limits for Singaporean Players

First and foremost, it is important to note that each e-wallet has its own deposit limits. These limits can vary depending on the e-wallet provider, the user’s account type, and the gaming site being used. In Singapore, some of the most popular e-wallets for online gaming include NETELLER, Skrill, and PayPal. NETELLER and Skrill, for instance, have different limits for each account level. The first level, a basic account, typically allows for E-wallet deposits at online casinos of up to $1,000 SGD.

e-Wallet with Skrill

Skrill is an excellent e-wallet that provides users with a secure, easy-to-use, and convenient way to manage their finances online. Its range of features, including its prepaid Mastercard, makes it a versatile tool for users looking to make online transactions.

What are the best e-wallets in Singapore?

In Singapore, there are several e-wallets available, but the best options are:

- GrabPay

- PayNow

- DBS Paylah!

- FavePay

- PayLah!

Summary

If you’re searching for an online casino that offers an exciting and reliable gambling experience, your search ends here with S-onebet. This platform provides a vast array of captivating games that will keep you entertained for hours. With a strong dedication to customer satisfaction, S-onebet goes above and beyond to ensure a secure and dependable payment method, such as e-wallets, is available for your convenience.

E-wallets have revolutionized the way transactions are made, providing a streamlined, cashless experience that is fast and efficient. In Singapore, the available e-wallet options are constantly expanding, with each app offering unique features and benefits.